🛢️ Supplier Vetting & Verification Protocol

Our Structured Process to Validate Suppliers and Ensure Product Authenticity Before Buyer Engagement

In today’s high-risk petroleum market, verifying a supplier’s authority, product access, and legal credentials is a critical first step before any draft SPA is exchanged or ICPO accepted. At Omega Crude, we follow a strict, ICC-aligned vetting protocol that protects our buyer relationships and preserves the integrity of each transaction. This process ensures we only work with authentic titleholders, refinery mandates, or allocation holders—not intermediaries without proper documentation.

Below is the exact step-by-step process we follow to vet suppliers. Understanding these expectations upfront increases transparency, saves time, and builds trust for all parties.

✅ Step-by-Step Supplier Verification Process

Supplying the World’s Fuel Needs with Verified Products, Structured Contracts, and Strategic Partnerships.

✅ Step 1: Role Declaration & Initial Disclosure

The supplier must clearly declare:

✅ Their legal role in the transaction: Titleholder, Mandate, Allocation Holder, or Reseller.

✅ Their relationship to the product source (refinery, storage terminal, or production facility).

✅ Whether they are exclusive sellers or selling on behalf of another party.

📌 Red Flag: Refusal to clarify role or vague claims such as “connected to allocation” without documents.

✅ Step 2: Corporate Identity & KYC Submission

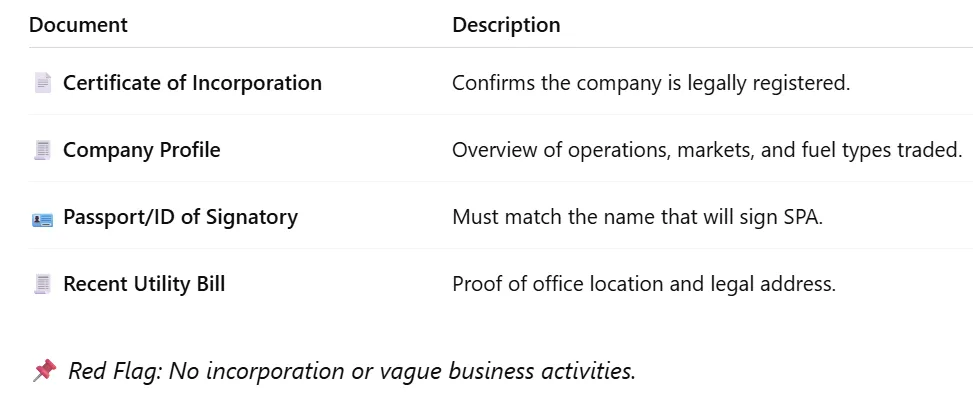

We require a complete KYC (Know-Your-Counterparty) package including:

✅ Step 3: Mandate Appointment or Titleholder Documentation

If the supplier is a mandate, reseller, or allocation holder, they must provide:

✅ Step 4: Proof of Product (POP) Pre-Screening

We request a verifiable POP package, even in redacted format, to prove the supplier has physical product access.

✅ Step 5: Price & Offer Evaluation (Platts-Aligned)

We review the draft offer (FCO or SPA) and evaluate:

Is pricing realistic and aligned with Platts index?

Is the discount structure within industry norms (no too-good-to-be-true)?

Are delivery terms CIF/FOB/TTT/TTO commercially viable?

Is the port of loading and terminal name stated clearly?

📌 Red Flag: Platts – $100/MT discounts or generic “CIF to any port” offers.

✅ Step 6: Financial Instrument Compatibility

We confirm that the supplier is:

Able to receive SBLC/DLC/RWA/MT103

Providing legitimate banking coordinates for soft probe (optional but preferred)

Using a bank that’s globally verifiable (SWIFT-enabled)

📌 Red Flag: No SWIFT details or fake bank letters with untraceable addresses.

✅ Step 7: Communication Channel Verification

We assess the supplier’s professionalism through:

Use of a corporate domain email (e.g., [email protected])

No exclusive reliance on Telegram/WhatsApp for formal documentation

Ability to hold Zoom/Teams video calls with signatories if required

📌 Red Flag: Gmail/Yahoo only, evasion of live calls, refusal to send real documents.

✅ Step 8: Compliance Documentation

We may request additional compliance-related documentation, including:

Export License (country-specific)

Corporate Tax ID or VAT certificate

Previous SPA reference (redacted)

📌 Red Flag: Lack of any historical compliance or delivery documentation.

✅ Step 9: Internal Approval & Buyer Matching

Once the supplier is vetted:

We present the supplier only to pre-qualified, verified buyers.

Both parties enter into NCNDA/IMFPA to protect commissions and confidentiality.

A buyer ICPO is requested only after POP verification and commercial alignment.

🛑 Common Red Flags That Disqualify a Supplier

If the supplier is a mandate, reseller, or allocation holder, they must provide:

🔒 Our Promise

We protect both our buyers and our reputation by only working with suppliers who are verifiably authorized, document-ready, and capable of closing fuel contracts. This step-by-step due diligence is non-negotiable — and is the reason our partners trust us to manage high-value petroleum transactions across global corridors.

Innovation

Fresh, creative solutions.

Integrity

Honesty and transparency.

Excellence

Top-notch services.

FOLLOW US

Omega Crude

📞 Phone: [+1-XXX-XXX-XXXX]

🌐 Web: https://omegacrude.com/home

📍 LinkedIn: www.linkedin.com/company/omega-crude

🛢️ D-U-N-S No. / Company Reg. / VAT:

COMPANY

CUSTOMER CARE

FL Office:

731 Duval Station RD,

Suite 107-151,

Jacksonville, Florida 32218

NY Office:

8225 Fifth Avenue,

Suite 221

Brooklyn, NY 11209

LEGAL

Copyright 2024. OMEGA CRUDE a ROGP Capital, LLC. Partner. All Rights Reserved.