🔍 Seller Vetting & Verification Protocol

Our Proven Process for Identifying Genuine Sellers and Eliminating Risk from Fuel Trade Engagements

At OMEGA CRUDE, every deal begins with one guiding principle: “No verification, no transaction.”

In today’s petroleum market — where fraudulent offers, recycled mandates, and unsubstantiated allocations are rampant — verifying the authenticity of the seller, their documents, and their product access is critical.

Below is our step-by-step seller verification protocol, designed to protect our buyers, uphold contractual integrity, and eliminate time-wasting or fraudulent intermediaries.

🛢️ Step-by-Step Seller Vetting Process

✅ Step 1: Initial Engagement & Role Disclosure

Before we review any documentation, the seller or intermediary must:

Clearly declare their role (Titleholder, Mandate, Allocation Holder, Reseller, etc.)

Identify if they are direct to the refinery, terminal, or allocation source

Provide a corporate email address (e.g., [email protected] — not Gmail or Yahoo)

📌 Red flag: Anonymous Gmail/Yahoo email, or claims of “allocation” without documentation.

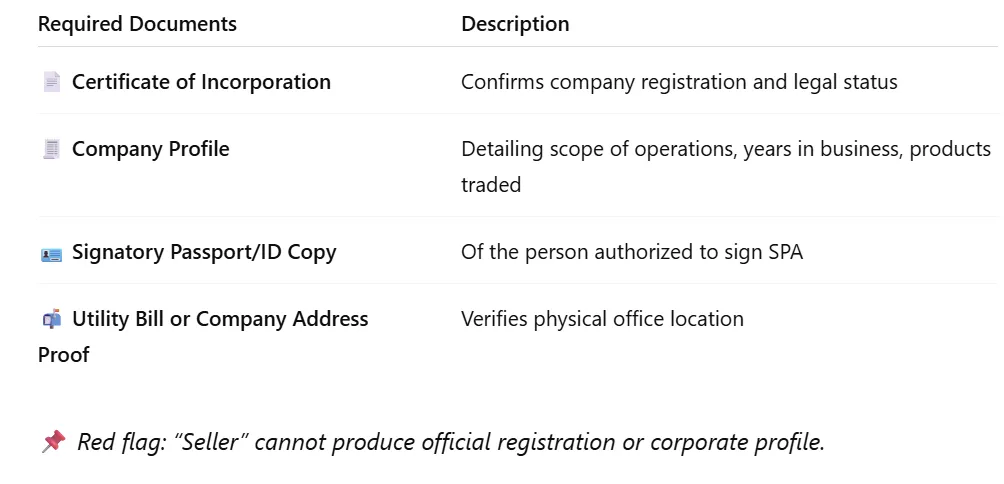

✅ Step 2: Corporate Verification (KYC)

We request the following Know-Your-Counterparty (KYC) documentation:

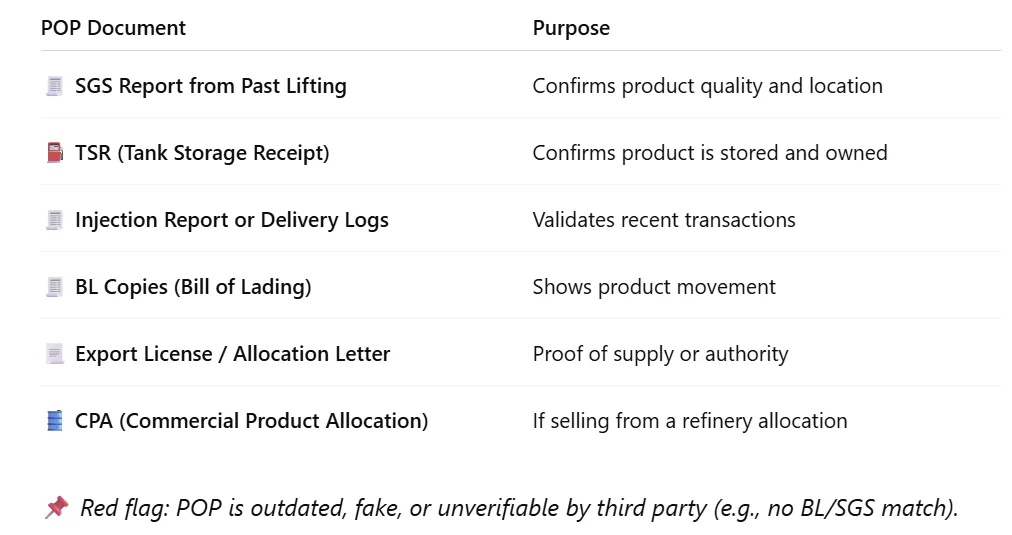

✅ Step 4: POP (Proof of Product) Review

We request a complete or partial POP package, redacted if needed, including:

✅ Step 5: Soft Probe Authorization (Optional but Preferred)

A legitimate seller with verifiable supply should allow a bank-to-bank SWIFT soft probe.

We request:

Bank name, SWIFT code, account name

Authorization to probe (for buyer’s bank only)

Contact person at the bank, if applicable

📌 Red flag: Seller refuses probe but claims to accept financial instruments.

✅ Step 6: Draft SPA Review

Before buyer issues a formal ICPO or SBLC, we review:

✅ Seller’s draft SPA or FCO (Full Corporate Offer)

Ensure:

Seller name matches KYC

Bank coordinates are listed for compliance check

CIF/FOB/TTT terms align with real market logistics

Inspection agency (SGS/BV) is acceptable

📌 Red flag: Seller refuses probe but claims to accept financial instruments.

✅ Step 7: Intermediary Chain Control

If the seller comes through brokers, we:

Request an NCNDA/ IMFPA signed by all intermediaries

Confirm maximum of 2 parties in the deal

Require mandates/intermediaries to show chain of title

📌 Red flag: More than 2 intermediaries involved or unclear mandates.

✅ Step 8: Internal Review & Buyer Match

Once all documents are vetted:

We present the seller to our verified buyers only

We align delivery port, product specs, quantity, and payment terms

If matched, we initiate buyer-side ICPO → SPA → RWA/SBLC

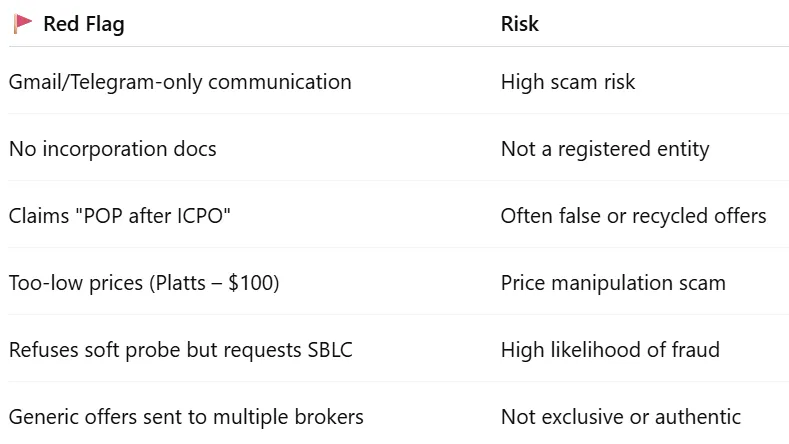

🛑 Final Warning Signs of a Fraudulent Seller

🛡️ Our Commitment

We maintain a strict “No SPA without verification” policy.

All sellers are subject to due diligence, bank screening, and allocation confirmation before being introduced to buyers. This protects your time, reputation, and financial exposure in every transaction.

Innovation

Fresh, creative solutions.

Integrity

Honesty and transparency.

Excellence

Top-notch services.

FOLLOW US

Omega Crude

📞 Phone: [+1-XXX-XXX-XXXX]

🌐 Web: https://omegacrude.com/home

📍 LinkedIn: www.linkedin.com/company/omega-crude

🛢️ D-U-N-S No. / Company Reg. / VAT:

COMPANY

CUSTOMER CARE

FL Office:

731 Duval Station RD,

Suite 107-151,

Jacksonville, Florida 32218

NY Office:

8225 Fifth Avenue,

Suite 221

Brooklyn, NY 11209

LEGAL

Copyright 2024. OMEGA CRUDE a ROGP Capital, LLC. Partner. All Rights Reserved.