🤝 Broker & Mandate Vetting Process

Our Due Diligence Protocol to Validate Intermediaries, Eliminate Risks, and Preserve Deal Integrity

In the fuel trade space, brokers and mandates often act as connectors — but without proper validation, they can also be a source of deal failure, misrepresentation, or fraud.

At OMEGA CRUDE, we implement a formal due diligence process to evaluate all brokers, facilitators, and self-declared mandates before engaging them in any buyer or seller transaction. This ensures we only work with transparent, professionally authorized, and contract-ready intermediaries who add value — not noise — to the process.

🛢️ Step-by-Step Broker & Mandate Vetting Protocol

✅ Step 1: Role Clarification & Position Disclosure

Each broker or mandate must disclose their exact position in the chain:

Are you a Buyer Mandate, Seller Mandate, or an Intermediary Broker?

Do you have a Letter of Appointment (LOA) or Direct Access to the Buyer/Seller?

Can you directly communicate with the end principal?

📌 Red flag: Ambiguous answers like “I work with someone close to the mandate” or “I’m in the chain but can’t disclose names.”

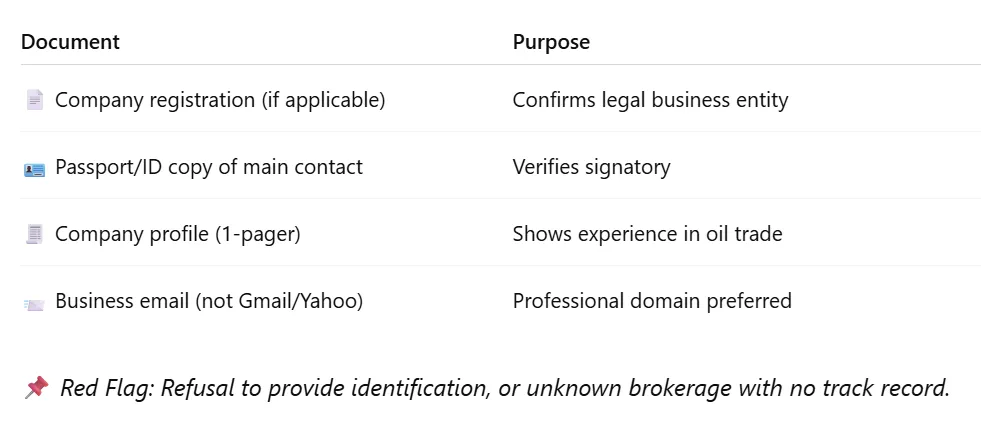

✅ Step 2: Corporate & Identity Verification

We require a basic intermediary KYC package:

✅ Step 3: Intermediary Chain Structure

We ask all intermediaries to clearly define the number of parties involved. Specifically:

Is there an NCNDA/IMFPA in place?

How many brokers are in the chain (we accept a maximum of 2 total)?

Who holds direct communication with the end party?

📌 Red flag: 5+ brokers in the chain or no formal agreement among brokers.

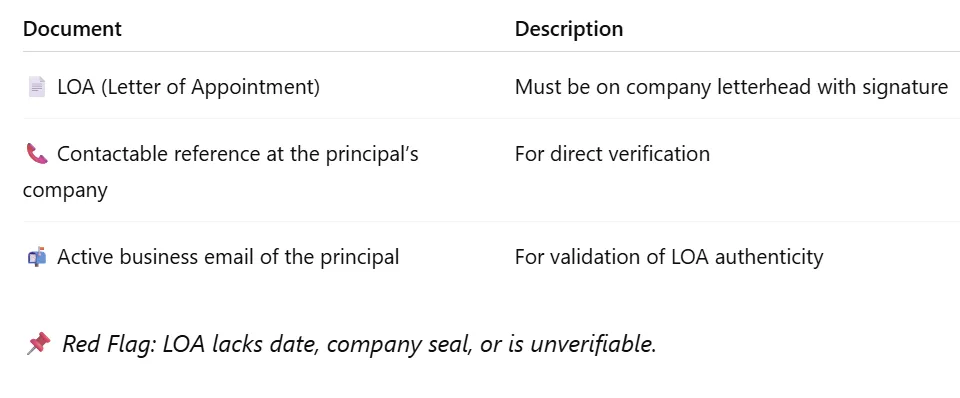

✅ Step 4: Authorization Verification (if Mandate)

If you claim to be a buyer or seller mandate, we require:

✅ Step 5: Experience & Product Familiarity

We assess whether the intermediary understands:

The difference between CIF, FOB, TTT, and TTO

Basic SPA structures and POP documentation

Financial instrument types: SBLC, DLC, MT103/23

Their product specialization (e.g., Jet A1, EN590, Crude)

📌 Red flag: Cannot define SPA, POP, or tries to “guess” standard procedures.

✅ Step 6: Working Style & Communication

We test for professionalism by asking:

Can they respond with structured emails and timely updates?

Are they able to hold Zoom or phone calls?

Are they requesting unnecessary buyer documents upfront (a common scam tactic)?

📌 Red flag: Constant Telegram-only communication, inconsistent responses, or unprofessional tone.

✅ Step 7: NDA/NCNDA/ IMFPA Agreement

Before working together, we insist on:

A standard ICC-format NCNDA

An IMFPA or commission structure discussed and acknowledged in advance

A commitment to non-circumvention and non-disclosure

📌 Red flag: Avoids signing NCNDA or tries to change ICC terms with vague clauses.

✅ Step 8: Deal Readiness Check

We check if the intermediary is able to:

Provide a live buyer or seller profile

Coordinate documentation exchange (e.g., draft SPA, ICPO, POP)

Remain involved in deal support — not just email forwarding

📌 Red flag: Tries to flip the deal to others, or disappears during compliance.

✅ Step 9: Red Flag Monitoring & Cut-Off Policy

We use a three-strike system for behavior like:

🚩 Fabricated documents

🚩 Misrepresenting authority

🚩 Pressuring for ICPOs without verifying seller offers

🚩 Excessive deal noise or time-wasting

📌 Any confirmed violation leads to immediate disqualification and blacklisting.

🛡️ Why This Matters:

We work in a space that requires legal precision, banking compliance, and reputational integrity. Our verified buyer and seller networks trust us because we vet every participant — including brokers and mandates — before allowing them access to high-value transactions.

By following this protocol, we create a safer, faster, and more productive trading environment for everyone involved.

Innovation

Fresh, creative solutions.

Integrity

Honesty and transparency.

Excellence

Top-notch services.

FOLLOW US

Omega Crude

📞 Phone: [+1-XXX-XXX-XXXX]

🌐 Web: https://omegacrude.com/home

📍 LinkedIn: www.linkedin.com/company/omega-crude

🛢️ D-U-N-S No. / Company Reg. / VAT:

COMPANY

CUSTOMER CARE

FL Office:

731 Duval Station RD,

Suite 107-151,

Jacksonville, Florida 32218

NY Office:

8225 Fifth Avenue,

Suite 221

Brooklyn, NY 11209

LEGAL

Copyright 2024. OMEGA CRUDE a ROGP Capital, LLC. Partner. All Rights Reserved.